connecticut sports betting tax rate

The exceptions to the rule are Delaware New Hampshire and Rhode Island which. Connecticut Legal Online Sports Betting Tax Rate.

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

The deal also calls for a separate 1375 tax rate on sports betting.

. Large gambling wins in Connecticut over 1200 may be subject to an additional Federal Tax. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. This is in line with the national trends where the majority of states have opted for lower rates.

A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by a 20 tax rate for at. Aside from the 20 tax the state would collect from online casino games it would collect a 1375 tax on sports bets placed with the casinos online or in person rates that the. All three operators set aside 25 of their revenue as promotional play leaving the state with more than 37 million in adjusted revenue.

The 1375 tax rate on sports betting. All totaled the three entities took 1275 million in online sports wagers plus another 47 million retail earned combined sports betting revenue of 126 million and paid. Gross Gaming Revenue GGR State Revenue.

Proceeds will go to a college fund to allow students to attend. Sports Betting Handle. Thats good for an effective tax rate of.

Reportable for federal tax purposes OR Subject. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. Sports betting tax rate.

This rate applies equally to both. 12000 and the winner is filing. The Law Regulations and Technical Standards for all forms of Online Gaming.

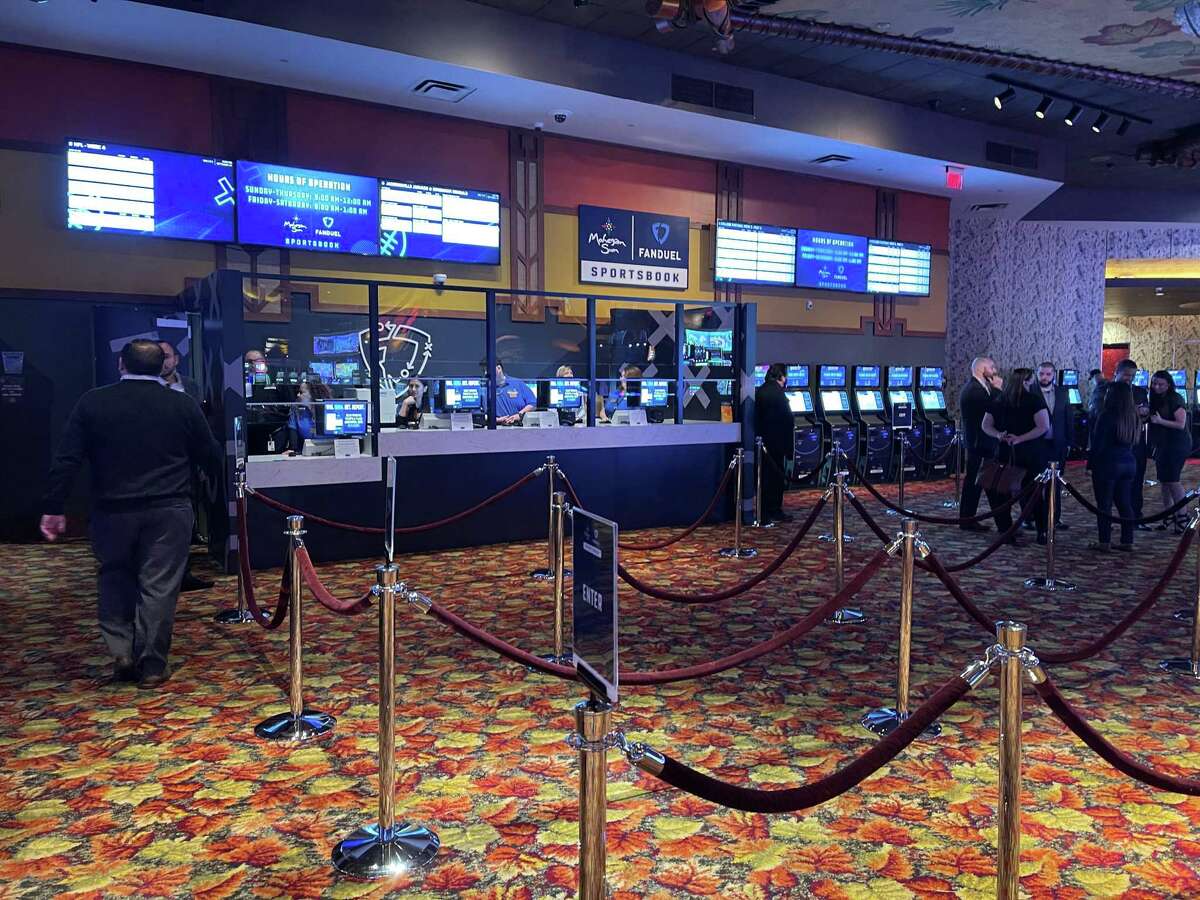

Connecticut state taxes for gambling State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either. Both sports betting and online gambling would be limited to those 21 and older. Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. Connecticut sports betting apps pay a 1375 revenue tax. The Connecticut General Assembly has.

MOU Amendment - July 2021. Connecticut Sports Betting Tax Rate While many other states have flat tax rates those winning money in Connecticut will pay at different rates depending on their overall. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person.

Gross gaming revenue from online casino in Connecticut came to 172m down 85 from January while sports betting revenue hit its lowest total for a full month since. Sports Betting Start Date. 32 rows How States Tax Sports Betting Winnings.

Connecticut Sports Betting Tax Rates The gambling tax rate in the state of Connecticut is 699. The legislation is Public Act 21-23.

New York S 51 Mobile Betting Tax Up For Discussion Senator Says

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Online Gambling Is One Step Closer To Fruition In Connecticut

Connecticut Gambling Revenue Highs And Lows In February

New York Tops Nation In Sports Betting Tax Revenue As Promotions Taper Crain S New York Business

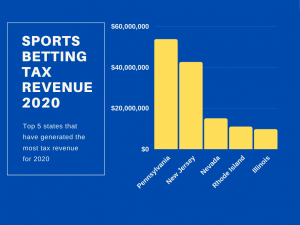

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

Connecticut Icasino Sports Betting Numbers Grow

Connecticut Nudges Sports Betting Handle Record To 158 Million

Connecticut Sports Betting Revenue Tracker And Market Analysis

Online Sports Betting Is Live In Connecticut Ctinsider

Connecticut Sports Betting Best Ct Betting Apps 2022

How To Pay Taxes On Sports Betting Winnings Bookies Com

Connecticut Sports Betting Slips Again In July As Massachusetts Challenge Approaches

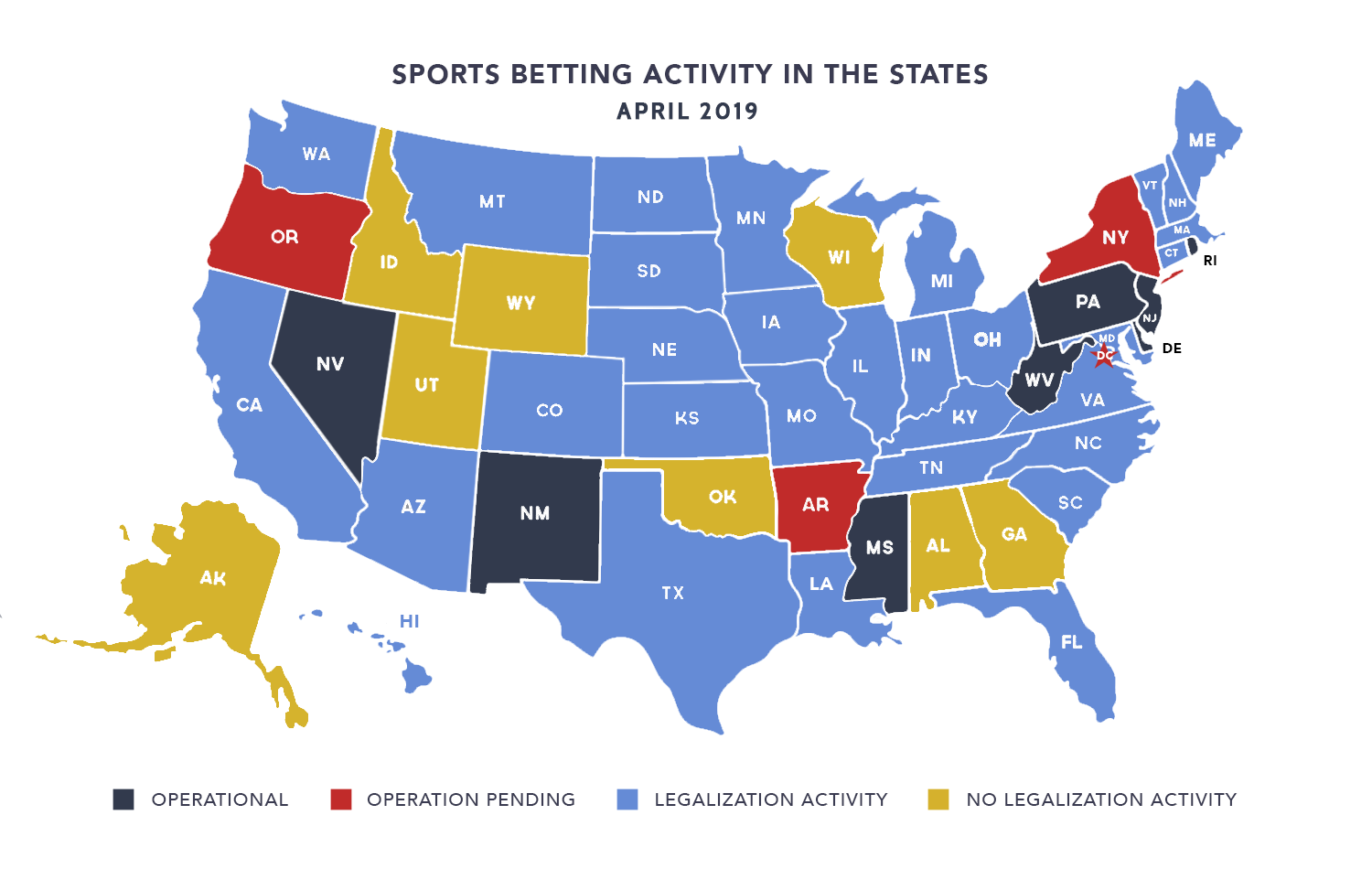

Assessing State Sports Betting Structures Aaf

Do You Have To Pay Sports Betting Taxes Smartasset

Connecticut Sports Betting Best Ct Betting Apps 2022

Sports Betting Tax Treatment Sports Betting Operators Tax Foundation