child tax credit 2021 eligibility

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. The ARP also enhanced eligibility.

2021 Child Tax Credit Advanced Payment Option Tas

3600 for children ages 5 and under at the end of 2021.

. Who qualifies for the child tax credit. Ad The new advance Child Tax Credit is based on your previously filed tax return. All children must possess a Social Security Number.

For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit. 3000 for children ages 6 through 17 at the end of 2021. The American Rescue Plan ARP temporarily expands the Child Tax Credit CTC from 2000 per child to as high as 3600 for the 2021 tax year.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. Ad Access IRS Tax Forms.

Up to 96 of US households with children qualify for at least some of the 2021 child tax credit. Complete Edit or Print Tax Forms Instantly. Specifically the Child Tax Credit was revised in the following ways for 2021.

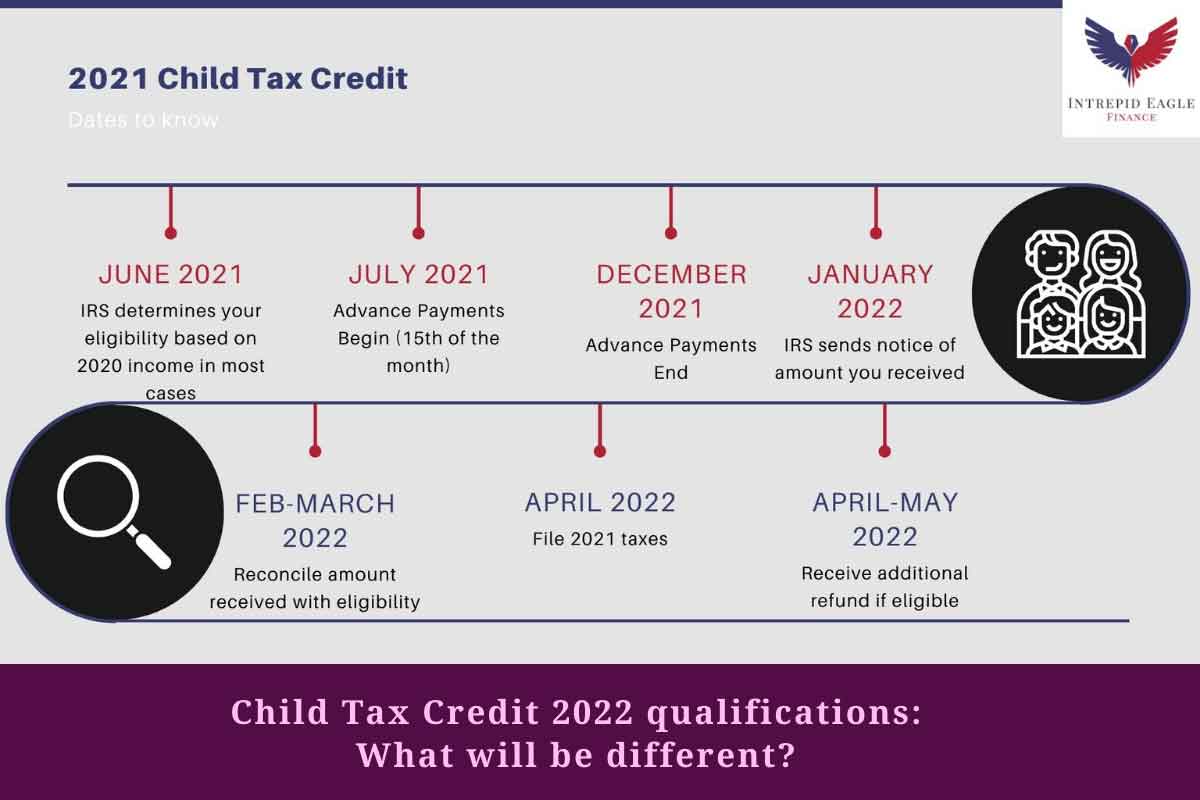

The remaining half of the credit for e ligible may be claim ed when the advanced payments are reconciled with the total eligible Child Tax Credit on the 2021 income tax return. In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. Ad Discover trends and view interactive analysis of child care and early education in the US.

Before 2021 the credit was worth up to 2000 per eligible child and children 17 years and older were not eligible for the credit. The phase-out threshold was increased from 75000 to 200000 for single filers and from 110000 to 400000 for those filing jointly. Your purchase may be eligible for eBay Money Back Guarantee if the return request is made within 3 days from delivery.

Up to 8000 for two or more qualifying people who need care up from 2100 before 2021. Making a new claim for Child Tax Credit. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

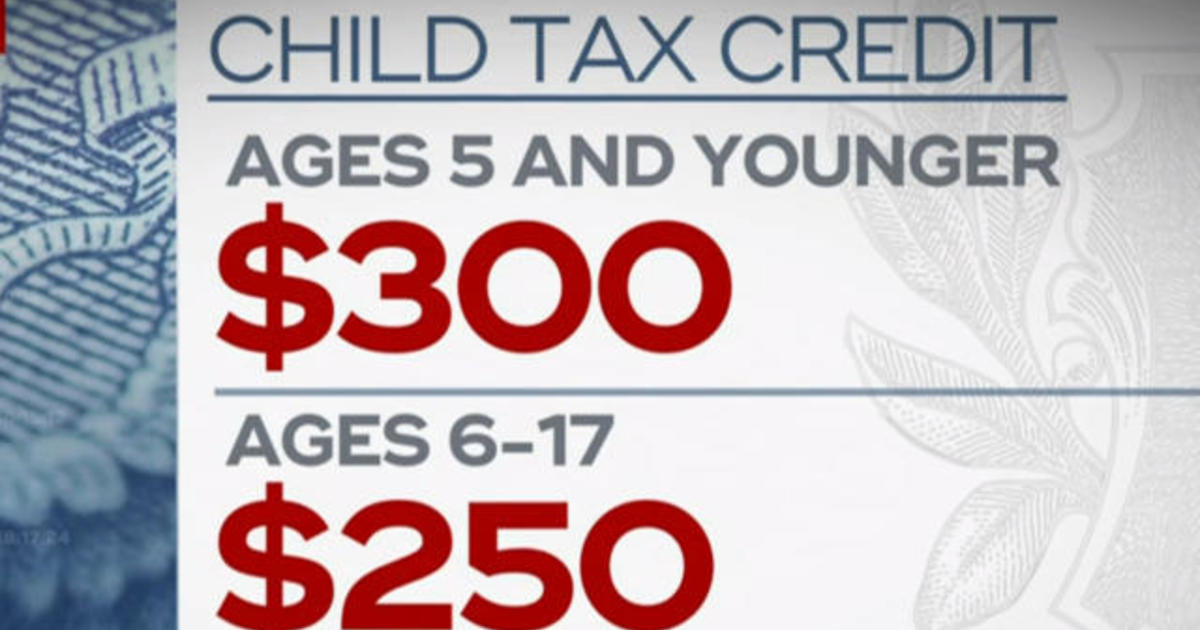

Half of the money -- up to 300 per month per child -- was distributed to eligible families who didnt opt out using the IRS Child Tax Credit Portal in 2021. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Fresh from pack to a protective sleeve and top loader.

Meet the income requirements which are different depending on whether you have children and are filing taxes jointly with a spouse. Additionally you will likely be able to claim periodic installments of this payment during the tax year. Generally to be eligible for the Earned Income Tax Credit you must.

Single or head of household or qualifying widow er 75000 or less. Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit. Half of the total amount came as six monthly payments so for each child up to age 5 you would have received six payments of up to 300 and for each child age 6-17 you would have received six monthly payments of up to 250.

In tax years before 2021 the child tax credit was an income tax credit for families of up to 2000 per eligible children under age 17 that was partially refundable. Key Points to Know. So under the new law children up to 17 years are eligible for the child tax credit.

For the 2021 tax year you can take full advantage of the expanded credit if your modified adjusted gross income is under 75000 for single filers 112500 for heads of household and 150000 for those married filing jointly. But age and income requirements could make families completely ineligible. Parents must have an earned income of at least 2500.

Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. You are bidding on a 2021 Bowman Draft Chrome CALVIN ZIEGLER 1st Bowman Auto NEW YORK METS CDA-CZ. Citizen or a resident alien for all of 2021.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. For 2021 you may have received in advance 50 of the Child Tax Credit during 2021. You will have to claim the remaining 50 on your 2021 Tax Return.

The plan will distribute approximately half of the due credit as direct payments to families split evenly among the remaining 6 months in 2021. The advance is 50 of your child tax credit with the rest claimed on next years return. Married filing a joint return.

Children also must have a Social Security number SSN to qualify for the 2021 child tax credit. You may be eligible to receive a fully refundable Child Tax Credit if your income is within the above mentioned threshold. Seller collects sales tax for items shipped.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. Already claiming Child Tax Credit. The credit amount was increased for 2021.

It added one year to the threshold age of the child. The child tax credit is a tax credit that gives financial aid to parents with children. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child.

The amount you can get depends on how many children youve got and whether youre. The credit was made fully refundable. The maximum Child Tax Credit payment was 3600 for each qualifying child up to age 5 and 3000 for each child age 6-17.

Have earned income through work during 2021. A qualifying child must be at least four but less than 17 years old on December 31st of the tax year and must qualify for the federal child tax credit. The iPhone at 15 Louis Vuitton smartwatch CES 2022 takeaways Attack on Titan final season Golden Globes 2022 How to find at-home COVID-19 tests.

This is the first year that 17-year-olds qualify for the CTC the previous age limit was 16. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. Get the up-to-date data and facts from USAFacts a nonpartisan source. See details - for.

Have a valid Social Security number. The 500 nonrefundable Credit for Other Dependents amount has not changed. Most families with children 17 and.

The law increases the Child Tax Credit from 2000 to 3000 for each child between 6 and 17-years-old and up to 3600 for each child under the age of 6. The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. Non-child dependents are now worth 500 in tax credits.

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital

Here S Who Qualifies For The New 3 000 Child Tax Credit

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Welcome You Are Invited To Join A Webinar Adoption Assistance Eligibility And Benefits After Registering You Will Receive A Confirmation Email About Joining In 2021 Foster Care Adoption Kinship Care Foster Care

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit 2022 Qualifications What Will Be Different

Child Tax Credit 2021 8 Things You Need To Know District Capital

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

The Child Tax Credit Toolkit The White House

What Families Need To Know About The Ctc In 2022 Clasp

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

2021 Taxes And New Tax Laws H R Block

Biden S 15 000 First Time Homebuyer Tax Credit Tax Credits Home Buying First Time

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience